Journal Entry for Returning a Tenant’s Security Deposit

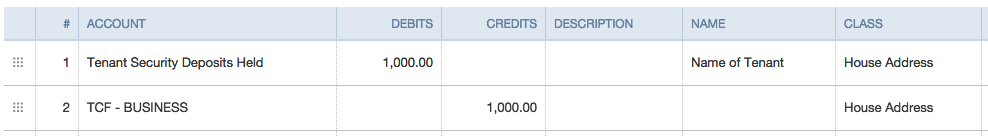

If you’re returning ALL of a tenant’s security deposit (good tenant, lucky you), the journal entry is very straightforward and is simply a reverse of the journal entry for receiving a security deposit. It looks like this …

Your liability account called “Tenant Security Deposits Held” gets debited and your checking account gets credited, meaning that money leaves your checking account (in the form of a check to the tenant) and your liability goes away. Again, no net change happens on the balance sheet.

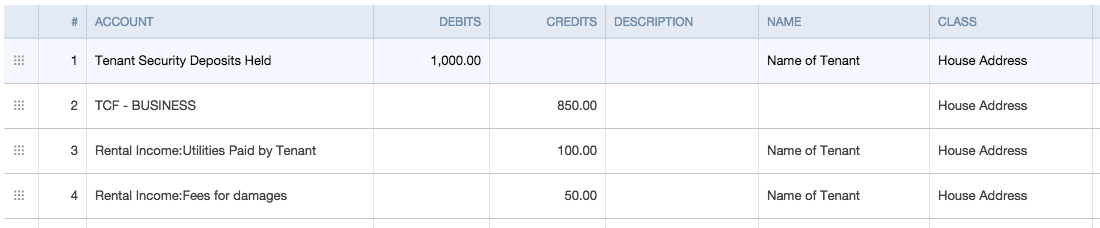

Now let’s way your tenant doesn’t leave the house in pristine condition (some repairs needed) and doesn’t pay all of their utility bills. The repairs and outstanding bills can come out of the security deposit. The way I do this is to convert the liability to income using two of my income accounts, “Rental Income:Utilities Paid by Tenant” and “Rental Income:Fees for damages”. Go ahead and create these income accounts now, then use the following journal entry to account for the partial return of a security deposit along with keeping some for repairs and unpaid bills.

In this example, $850 goes back to the tenant (as a check written out of the account called “TCF-Business”) and a total of $150 becomes income. The expenses that will occur because of the repairs and utilities can then be treated as normal expenses.

If you have any question related to returning security deposits, or any other real estate bookkeeping-related issue, please let me know and I’ll do my best to explain.

Thanks for the help. I set up the accounts and will go back into 2014 and correct some messy accounting. I had no idea how to handle but it seems simple now.

Thanks for the help.

Paul

That’s great to hear Paul. Let me know if you run into any more issues.

I asked tenant for first and last months rent (no security deposit) on a month-month lease. When the tenant moves how do I handle that last month rent? Thank you. Minnie Brown.

Minnie,

What I would do in this situation is this …

When they pay their first and last month’s rent, the first month’s rent goes straight to the P&L statement as income. The last month’s rent goes to the balance sheet as a liability, much like you would treat a security deposit. Assuming that everything goes well throughout the period of the contract, at the start of the last month, do a journal entry and move the liability to income. It’s actually pretty much the exact same process as using a security deposit. The two types of prepayments are similar in the sense that they are both money held by you in a type of escrow arrangement. When you hold money in escrow it’s a liability on your balance sheet. The difference is that at the end, the escrow goes completely to income in your case whereas it would go to repairs or back to the tenant in the case where there is a security deposit involved.

I hope that helps!