Journal Entry for Tenant Security Deposit

When you receive a security deposit from a tenant, your cash balance goes up (asset) which means that you need to have a corresponding increase in a liability account. Remember, if you’re using the double-entry bookkeeping system (which you are if you are using Quickbooks Online), all transactions need to balance out, expenses need to balance with a decrease in an asset, etc.

Here are the steps create a journal entry to account for receipt of a tenant security deposit:

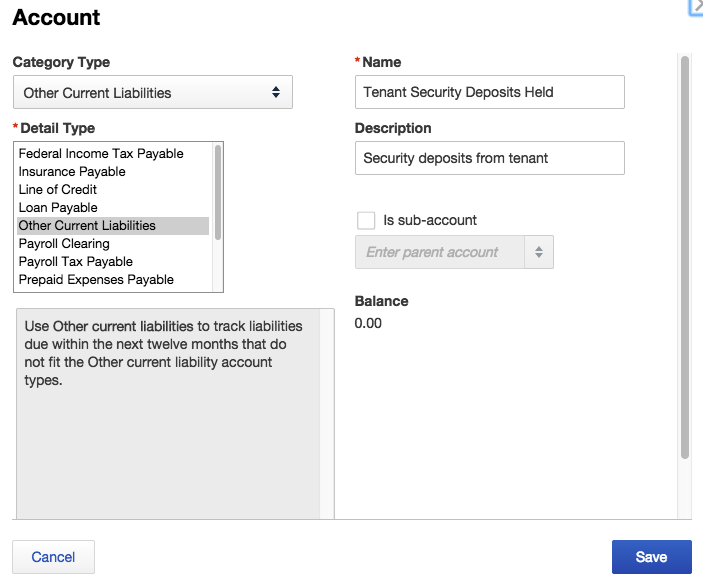

1. Create a liability account to hold the security deposit

Remember, the funds that the tenant gave to you are not yours, they belong to the tenant. You are only holding them and you need to return them when the tenant moves out. Money that you receive that you didn’t earn usually ends up in a liability account and a tenant security deposit is no exception. Here is what the account creation should look like:

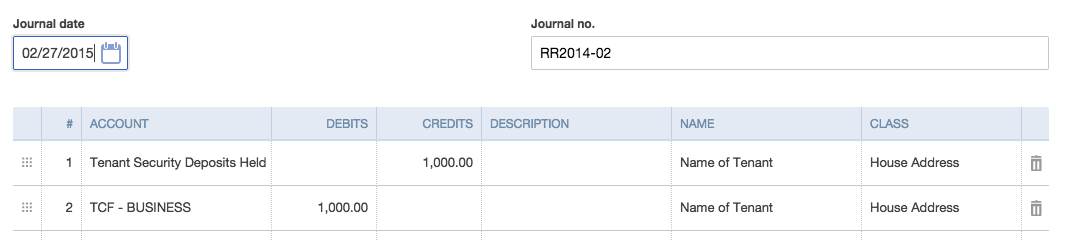

2. Use the following journal entry to record receipt of security deposit:

So what just happened? Your liability account that you just created got increased by $1000 and the balance of your checking account called “TCF-Business” increased by $1000. It’s a little bit confusing that a debit causes an increase but that’s just the way it is. When you debit an asset account, it increases. Since these transactions are offsetting, there is no net change to your balance sheet. When you’re ready to return the security deposit, use this journal entry.

If you have any questions related to bookkeeping transactions for rental properties, please feel free to drop me a note and I’ll respond with an answer.